Students could lose thousands

by Miriam Ostermann

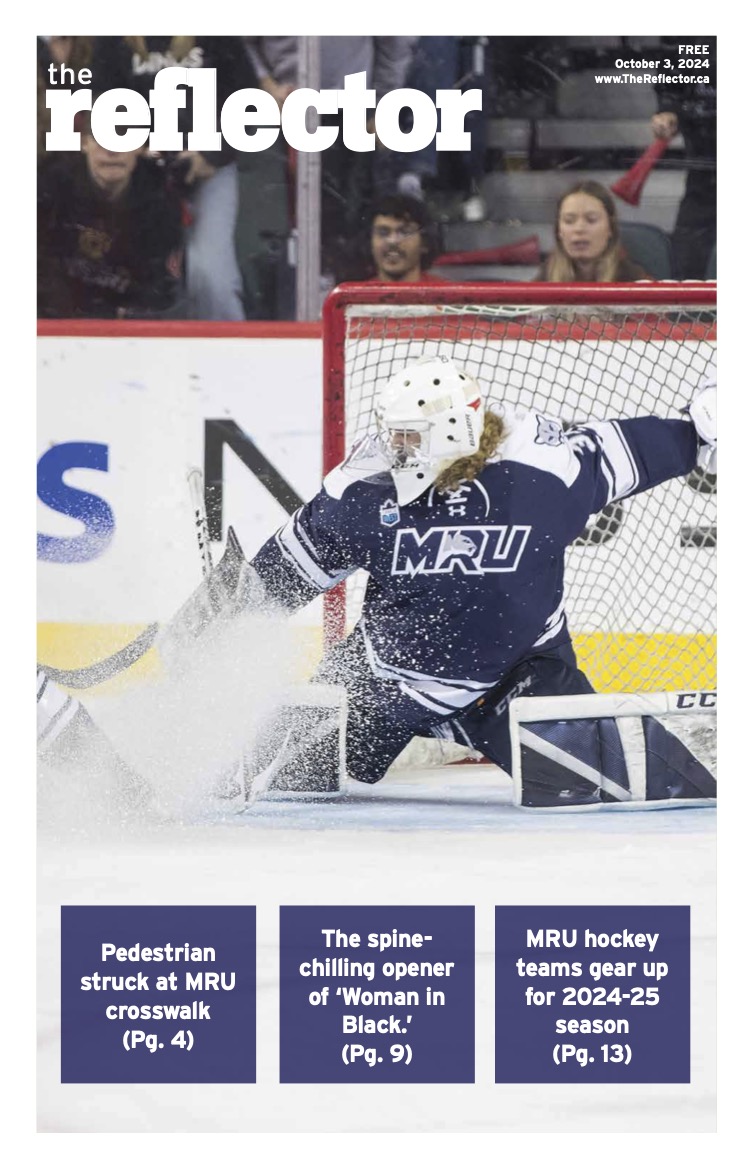

Photo by Miriam Ostermann. The SAMRU, including VP external Meghan Melnyk, does not support a move to eliminate provincial tuition and education tax credits.

A controversial document, submitted to the provincial government by the Council of Alberta University Students, has left Alberta universities divided on an issue to eliminate the provincial tuition and education tax credits. The proposal suggested that the government’s budget for education tax credits — estimated at $110 million — should be redirected into student financial aid.

For every month that a student is in school, the provincial government provides them with $460 that they can claim against their taxes. Depending on a student’s income, up to $4,000 can be claimed. Each year, the organization, commonly known as CAUS, submits an annual budget that specifies changes and adjustments the group is lobbying for. While seen as a worthwhile investment by the University of Calgary, the University of Lethbridge and the University of Alberta — the three schools represented by CAUS — Mount Royal University and the Alberta Students’ Executive Council (ASEC) oppose the idea. As a result, ASEC produced a document addressing its position and that of the 12 institutions it represents.

However, a counter-proposal has not been issued by ASEC or the Students’ Association of Mount Royal University, said Meghan Melnyk, VP external. In the event that CAUS’s submission gains traction in the legislature, a counter-proposal will be produced. “Tax credits are incredibly beneficial to our students, and our students do use them,” Melnyk said. “We have more and more of our students who work through school so the tax credits do benefit them when they get out.

“Tax credits, for their flaws, are a much better program than putting more grants out there because they’re not being used and as widely available and accessible to students in general (since) there are a lot of hoops you have to jump through (to get grants).

“But everyone files taxes, that’s the beauty of it.” Melnyk said Mount Royal would like to see provincial money disbursed when students graduate and are burdened with everyday bills and payments. She said this plan benefits Mount Royal students because tax credits can be used for anything by anyone who helped pay for the education — such as a student’s parents.

According to the Edmonton Journal, a student’s provincial tax credit is worth about $1,000 per year. “For us it’s about access,” said Hardave Birk, chair of CAUS. “And up-front grants help accessibility much more than back-end assistance does, and tax credits are back-end assistance. I think at the end of the day, ASEC, CAUS and Mount Royal always want students to have the ability to go to school and have the options available to pursue a post-secondary education.

“CAUS is just putting it in a different way because we’re looking at up-front access for students when they’re first entering the system. We’re talking about how to make the system better overall, and there’s nothing wrong with having a conversation.”

Psychology student Kitty Wharry disagreed with CAUS’s reasoning, arguing that tax credits were a big incentive in her decision to enroll at Mount Royal this year. Wharry, who works two jobs, said students who have family financial support and minimal work hours have more time to focus on their studies, thus receiving higher grades and are eligible for more scholarships — tipping the scales in favour of students who don’t have to work their way through school.

“It’s just like when you save all your bottles, you don’t get your money back until you go to the depot, and in the end it’s as if you saved all that money aside,” Wharry said. “Who are these people that say you can’t have your own money back? People already have enough problems. Obviously, if you get your money back you are benefiting from it, and now it’s as if I have to try to get money that I was entitled to.”

Birk said the process of applying for some scholarships is fairly simple. Yet the proposal does not address any changes to the process in the future and there were no concrete details as to whether it will be made easier for students to apply for and receive financial aid if the government were to eliminate tax credits.

It boils down to accessibility versus affordability. Whereas ASEC considers affordability, CAUS’s policy places focus on accessibility — raising enrollment.

“I’ve discussed this with CAUS, and their tax credit policy might work for the students that they represent,” said Steven Kwasny, chair of Alberta Students’ Executive Council. “However, the demographic of students that ASEC represents — just a wider variety of types of students — cutting tax credits wouldn’t do much in terms of an overall benefit to students, and from that perspective we don’t support it.”

The proposal is currently in the hands of the provincial government, but more information should be released to organizations and Alberta students later this month.