Coughing up more for coverage

by Bryan Weismiller

News Editor

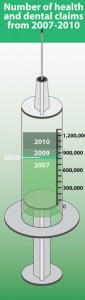

Mount Royal University students will have to pay an additional $34.50 to receive coverage from the Students’ Association of Mount Royal University’s health and dental plan starting next year.Given the current funds being generated from benefit fees, the SA is expected to lose just under $25 per student in 2010-2011. A larger loss of $34 per student was projected for the 2011-2012 school year.

The students’ association called a special general meeting on March 3 to address the projected deficits.

Benefit fees have been raised one per cent yearly for the last decade, but the number of claims has simply outgrown the fee increases. Reserve funds are currently being used to mitigate the shortfall.

“We don’t have enough money to cover all of the claims that are being made,” said Robert Jones, students’ association president. “The picture I’m painting for you guys is a grim one if we don’t increase our fees (then) this gap is going to get bigger and bigger.”

Jones said it’s a “mystery right now” as to why more people are making benefit claims. He said given that more people are here for

four years rather than two that they may be more interested in finding out about the plan. He added that since the economic recession, more people are looking for ways to save money.

“We were hoping that usage would go down a little — that it was an anomaly, but it looks like it’s a new trend,” Jones said.

Students at the March 3 meeting were presented with three different options for covering the shortfall. One solution was to cut the maximum dental claim to $750, lower drug coverage to 70 per cent and reverse previous changes to paramedical allowances that cover things like physiotherapy.

The fee increase was another option and a combination of both was also presented. Students overwhelmingly voted in favour of passing the motion to increase fees.

“Even though it is 18 per cent, we have to be realistic that things in life are costing more, so we can’t have the luxuries and enjoy things as they were before,” said student Missy Chareka who — by using the plan — saved $1,000 getting her wisdom teeth removed.

“The plan has been great and I don’t want it to get cut,” said Nathan Johnson, whose wife and child are also covered under his student plan. “I get to keep those things and $35 isn’t much, especially when you’re looking at the alternative.”

Although most students seemed to support the increase, Cassie Leszczynski denied the motion. She said that increasing the fees “won’t solve anything” and that they’re “just going to keep increasing.”

Leszczynski said raising fees would likely increase the number of people who opt-out of the plan, which would cause further increases to cover the shortfall. When asked, Robert Jones didn’t rule out further increases next year. However, he said next year’s executive council would have to make that decision.

“The reality is that right now the costs are out of line with the coverage and by bringing the costs up they now fit the coverage,” said Bryan Boechler, director of student services for Gallivan & Associates. “We now have more of an even playing field.”